Your cart is currently empty!

Free shipping on all orders over $50 ・ Use cods15 at checkout to get 15% off

Accounting for Crypto Assets: Accountants, Tax Professionals and Investors…

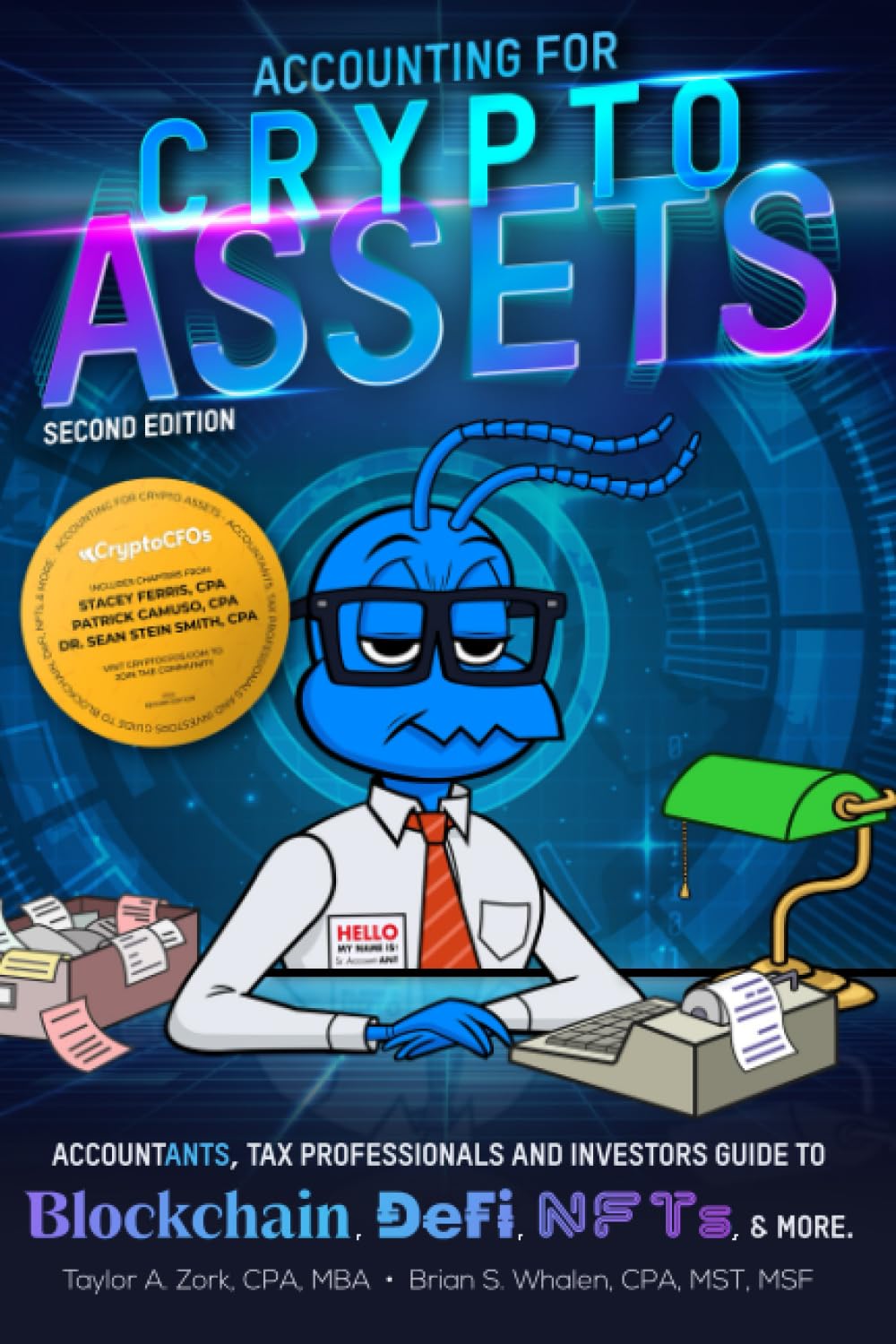

Accounting for Crypto Assets: Accountants, Tax Professionals and Investors Guide to Blockchain, DeFi, NFTs, & more. Paperback – July 27, 2023 As the Web 3.0 era unfolds, owning digital assets is the new normal. This second edition of “Accounting for Crypto Assets” is your comprehensive guide to navigating this paradigm shift. This book provides the…

Description

Accounting for Crypto Assets: Accountants, Tax Professionals and Investors Guide to Blockchain, DeFi, NFTs, & more. Paperback – July 27, 2023

As the Web 3.0 era unfolds, owning digital assets is the new normal. This second edition of “Accounting for Crypto Assets” is your comprehensive guide to navigating this paradigm shift. This book provides the tools to understand and monetize this trillion-dollar asset class, equipping you with the knowledge to service this colossally underserved market as a professional or investor.This updated second edition expands on previous insights and includes guest chapters from industry experts Stacey Ferris, CPA, Patrick Camuso, CPA, and Dr. Sean Stein Smith, CPA. Stay ahead of the curve with current regulations and learn to think critically about integrating digital assets into accounting practices.Beyond the book, the CryptoCFOs community – www.CryptoCFOs.com – offers a wealth of resources, networking opportunities, and up-to-date trends in crypto, NFTs, Web3, and blockchain. Master the future of finance with “Accounting for Crypto Assets” and CryptoCFOs. Read more

Product Features

Shipping:

Shipping is complimentary within the lower 48 US States.

- We Do Not Ship to PO/APO Boxes, HI or Alaska

- We Do Not Ship Outside of the Continental US

- All items ship within 4-72 hours of Payment

- For oversized items shipped via freight, a valid phone number is needed so the carrier can contact you to arrange delivery.

Terms of Sale and Customer Feedback

- We highly value your opinion and strive to provide a positive shopping experience for every customer.

- If you are satisfied with your purchase, we kindly invite you to leave positive feedback. Your satisfaction is our highest priority.

- Should any issues arise with your order or delivery, we encourage you to reach out to us directly before leaving neutral or negative feedback. We are committed to resolving any concerns promptly and professionally.

- We appreciate the opportunity to make things right and earn your trust—please allow us that chance.

Returns & Customer Concerns

- Most new, unopened items sold by Compod Shop can be returned within 30 days of delivery for a full refund, in accordance with our return policy.

- Return shipping costs are the responsibility of the buyer unless the item arrived damaged or incorrect.

- Before placing your order, please ensure the product meets your needs. Customer satisfaction is our top priority, and we’re happy to help with any pre-purchase questions.

- All products listed are in stock at the time of publication; however, inventory is subject to change without notice due to high demand across multiple sales channels.

- If an item becomes unavailable after purchase, we will issue a prompt and full refund. We kindly ask for your understanding in such rare cases.

Reviews

There are no reviews yet.